Choosing the right personal loan interest rate can save you thousands of rupees over the loan tenure. In India, borrowers often compare PSU (Public Sector Undertaking) banks with private banks to find the most competitive rates, better service, and flexible terms. This in-depth guide breaks down current rates, features, benefits, hidden charges, and smart strategies to pick the best personal loan option in 2026.

Understanding Personal Loan Interest Rates in India

Personal loans are unsecured loans, meaning they don’t need collateral. Because of this, interest rates tend to be higher compared to secured loans like home loans.

What determines personal loan interest rates?

- Your credit score and credit history

- Income and employment stability

- Loan amount and tenure

- Bank’s internal policies and risk appetite

PSU banks and private lenders price risk differently, so rates and terms vary significantly.

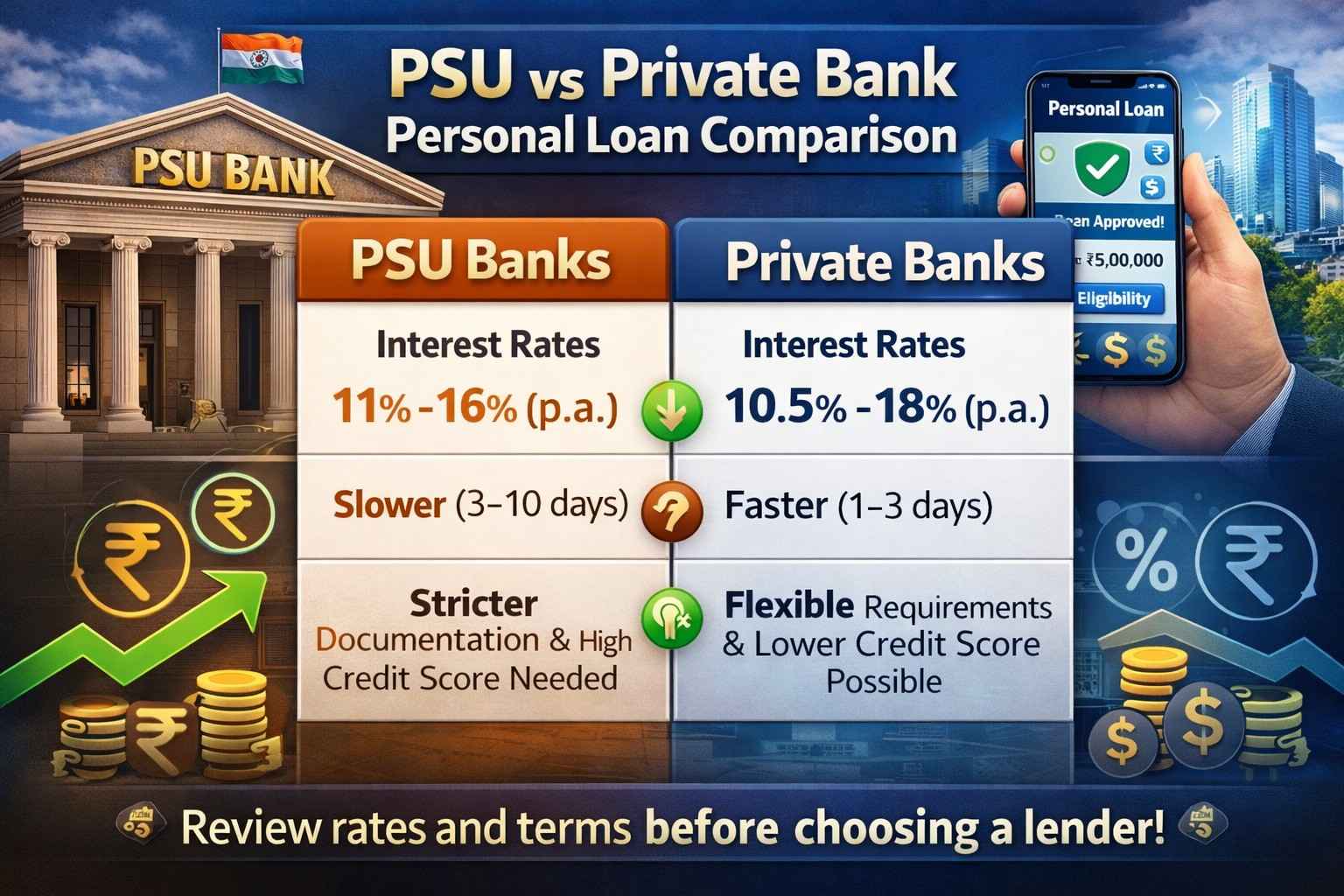

Current Personal Loan Interest Rates: PSU Banks vs Private Banks

Here’s a snapshot of typical interest rates in India (note: actual rates can vary based on profile and offers):

| Lender Type | Approx Interest Rate Range (p.a.) | Typical Loan Tenure | Eligibility Strength |

|---|---|---|---|

| PSU Banks | 11% – 16% | 1–5 years | Stricter documentation & credit checks |

| Private Banks | 10.5% – 18% | 1–5 years | More flexible but higher risk-based pricing |

Note: These ranges are indicative and subject to change. Always check the latest rates directly from banks or financial marketplaces.

PSU Banks: Pros & Cons for Personal Loans

Pros of PSU Banks

- Lower Base Rates: PSU banks often start with more conservative interest rates, especially for salaried individuals.

- Trust & Stability: Established reputation and clearer regulatory compliance.

- Longer Loan Tenure Options: Many offer extended repayment periods.

Cons of PSU Banks

- Slower Processing: More documentation and procedural delays.

- Stricter Eligibility: Higher credit score requirements and limited flexibility.

- Fewer Instant Offers: Less focus on digital quick approvals compared to private banks.

Who should choose PSU banks?

If you have a steady job, strong credit score, and value structured banking experience over speed.

Private Banks: Pros & Cons for Personal Loans

Pros of Private Banks

- Faster Approvals: Many provide instant or same-day approval with minimal physical paperwork.

- Flexible Eligibility: Easier acceptance for young professionals and new credit borrowers.

- Competitive Offers: Frequent promotional rates and online discount deals.

Cons of Private Banks

- Possibly Higher Interest: Especially for lower credit score applicants.

- Higher Fees: Processing fees and prepayment charges may be steeper.

- Variable Customer Service: Quality may vary widely.

Who should opt for private banks?

If you need quick funds, prefer digital processing, or have a newer credit profile.

Side-by-Side Comparison – Key Parameters

1. Interest Rates

- PSU: Generally stable but less flexible.

- Private: Competitive for good credit profiles, but higher risk pricing.

2. Processing Time

- PSU: 3–10 business days.

- Private: 1–3 business days or instant online offers.

3. Documentation

- PSU: Requires thorough verification.

- Private: Focus on digital KYC and quick checks.

4. Eligibility

- PSU: Strict credit score and income parameters.

- Private: Wider options, sometimes lower minimum thresholds.

5. Service & Accessibility

- PSU: Branch network and regulated practices.

- Private: Better tech support, app notifications, loan trackers.

Hidden Costs & Charges You Must Check

When comparing loans, don’t just focus on interest rate. Some additional costs include:

- Processing Fee: Usually 1–3% of loan amount.

- Late Payment Penalty: Can significantly raise your effective cost.

- Prepayment Charges: Check if the bank charges for early closure.

- GST on Charges: Applicable on processing and other fees.

These can add to your total cost of borrowing.

How to Choose the Best Between PSU & Private Banks

- Check Your Credit Score: A 750+ score often gets you the best interest rate.

- Compare APR, Not Just Nominal Rate: Annual Percentage Rate includes fees.

- Evaluate Customer Reviews: Look for turnaround time and service experiences.

- Negotiate Terms: Some banks may match competitor rates.

- Use Loan Comparison Tools: Online aggregators help you filter offers quickly.

Example: Impact of Interest Rates on EMI

Let’s say you borrow ₹5,00,000 for 5 years:

| Interest Rate | EMI (Approx) | Total Interest Paid |

|---|---|---|

| 11% (PSU) | ₹10,876 | ₹1,52,560 |

| 14% (Avg) | ₹11,836 | ₹1,70,160 |

| 17% (Private) | ₹12,578 | ₹1,94,680 |

Even a few percentage points difference affects your total cost significantly.

Tips to Lower Your Personal Loan Interest

- Improve credit score before applying.

- Opt for shorter tenure if affordable.

- Maintain financial stability and provide proof of income.

- Use salary account relationship benefits if available.

- Apply with a co-applicant to strengthen eligibility.

FAQ

What is the typical personal loan interest rate in India for 2026?

Personal loan interest rates in India generally range between 10.5% and 18% depending on credit profile and lender type.

Do private banks offer better rates than PSU banks?

Private banks may offer lower rates to high credit score applicants, but PSU banks can be more consistent and sometimes cheaper for stable borrowers.

Can I negotiate personal loan interest rate?

Yes, banks often allow negotiation, especially if you have a strong credit history or competing offers.

Which is better for quick loan approval?

Private banks usually provide faster approval and disbursal, often with digital processes and minimal paperwork.

How much does my credit score affect my loan interest rate?

A higher credit score improves your chances of lower interest rates and better loan terms.

Conclusion

Comparing personal loan interest rates between PSU and private banks is crucial if you want to minimize borrowing costs. PSU banks offer stability and decent rates for strong profiles, while private banks shine with faster processing and competitive digital offers. Analyze your financial profile, compare APRs including fees, and choose the lender that aligns with your repayment ability and goals.

Write a comment