Choosing the right bank for a savings account in India can impact your financial journey significantly. Among the most popular choices are State Bank of India (SBI), HDFC Bank, and ICICI Bank — each offering unique advantages and features. This comparison will help you determine which savings account aligns best with your financial goals, lifestyle, and banking habits.

In this detailed comparison, we’ll break down:

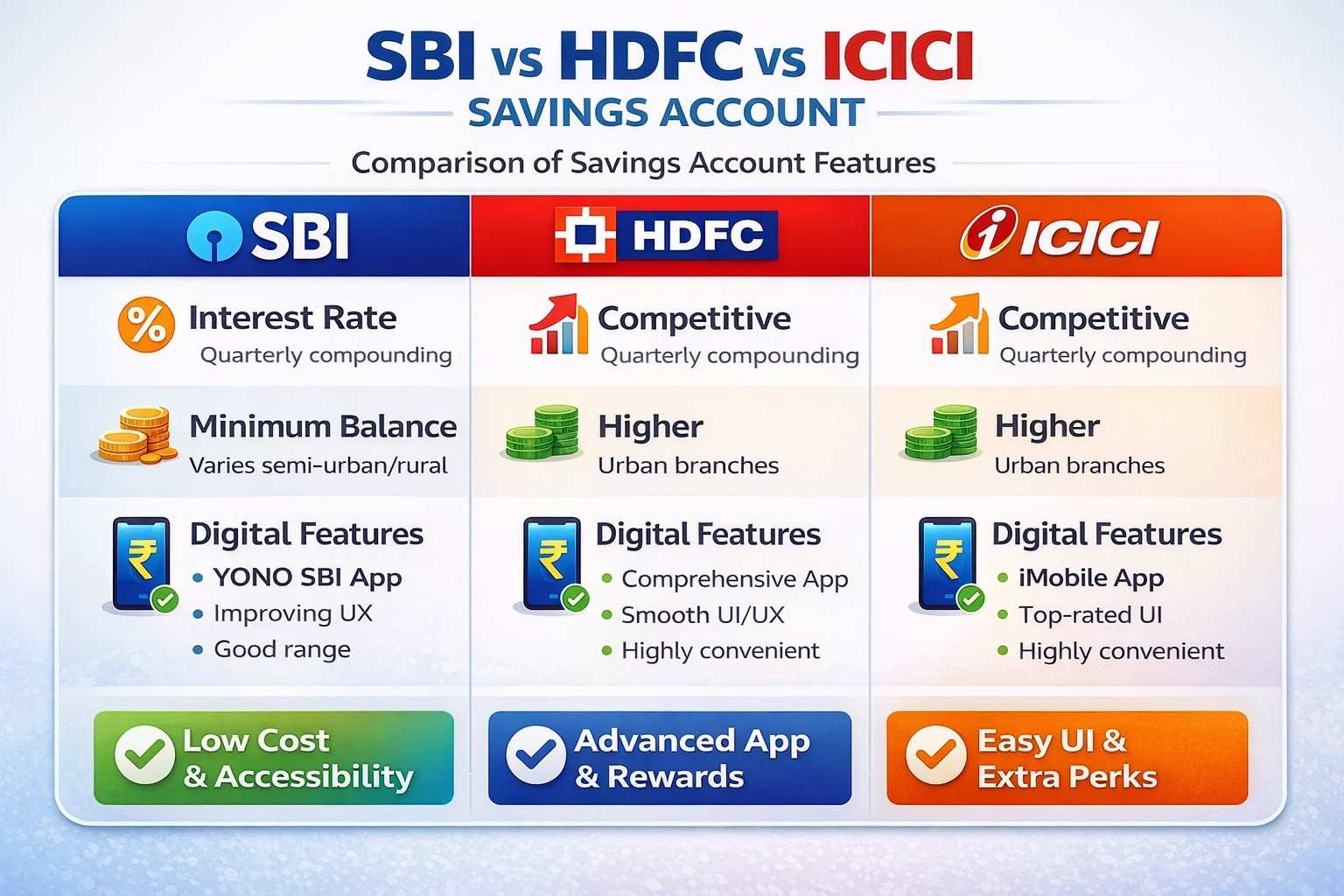

- Interest rates and returns

- Minimum balance requirements and charges

- Digital banking & technology

- Customer service & branch availability

- Additional benefits & perks

- Who each bank is ideal for

Let’s dive in and compare SBI vs HDFC vs ICICI savings accounts across essential factors so you can confidently choose the best one for you.

Understanding the Basics of Savings Accounts

What Is a Savings Account?

A savings account is a basic bank account designed to help you store your money safely while earning interest. It also provides easy access to your funds, allowing transactions such as deposits, withdrawals, online transfers, and payments via debit cards or mobile banking.

Why Choosing the Right Bank Matters

While all banks offer savings accounts, the benefits, costs, and services vary widely. Differences in interest rates, minimum balance requirements, digital features and customer support can influence your banking experience and the growth of your money.

Interest Rates: Who Gives You More?

Interest earned on your savings balance is one of the most important things to consider when opening an account.

State Bank of India (SBI)

- SBI typically offers interest on savings balances that aligns with or slightly above the national average for large banks.

- Interest may vary based on the amount held (slabs).

- Interest is compounded quarterly.

HDFC Bank

- HDFC Bank often offers competitive savings account interest rates.

- Sometimes attractive for customers with higher account balances.

- Interest credited quarterly.

ICICI Bank

- ICICI Bank also provides competitive interest rates that can be similar to HDFC’s, especially for premium accounts.

- Interest compounding and credit frequency can align with industry norms.

Quick Comparison (Illustrative):

| Bank | Typical Savings Interest | Compounding |

|---|---|---|

| SBI | Moderate | Quarterly |

| HDFC | Competitive | Quarterly |

| ICICI | Competitive | Quarterly |

💡 Note: Exact interest rates change based on RBI guidelines and bank policies. It’s always best to check the latest rates on official bank websites before deciding.

Winner for Interest: Tie between HDFC and ICICI if they lead slightly above SBI at the time of comparison.

Minimum Balance & Charges: Cost of Banking

One of the biggest pain points for bank account holders is maintaining the minimum balance and avoiding charges.

SBI

- Minimum Balance: Lower compared to private banks, especially in semi-urban and rural areas.

- Charges: Less aggressive penal charges for non-maintenance of balance.

- Advantage: Good for students and first-time account holders.

HDFC Bank

- Minimum Balance: Higher amounts required, especially in urban branches.

- Charges: Penal charges for not maintaining the balance can be significant.

- Advantage: Often comes with additional perks for premium tiers.

ICICI Bank

- Minimum Balance: Comparable to HDFC, varies by location and account type.

- Charges: Similar penal charges for breach of minimum balance.

- Advantage: Flexibility in different types of savings accounts.

Quick Comparison:

| Bank | Ease of Maintaining Balance | Charges for Non-Maintenance |

|---|---|---|

| SBI | Easier | Lower |

| HDFC | Harder | Higher |

| ICICI | Harder | Higher |

Winner for Minimum Balance & Charges: SBI — especially for customers prioritizing low cost and flexibility.

Digital Banking & Tech Experience

In today's digital world, the strength of a bank’s mobile app and online services is crucial.

SBI

- YONO SBI app integrates banking, investments, shopping, and payments in one place.

- User experience is improving but occasionally reported as slower compared to private banks.

- Good range of digital services and QR payments.

HDFC Bank

- HDFC MobileBanking App is known for smooth UI, quick functions, and reliable performance.

- Strong online banking features with regular updates and security features.

- Seamless fund transfers and bill payments.

ICICI Bank

- iMobile by ICICI Bank is a highly rated mobile banking platform.

- Offers intuitive navigation, multi-feature dashboard, and easy transactions.

- Often competes neck-to-neck with HDFC’s app.

Digital Experience Summary:

| Bank | App Quality | Ease of Use | Features |

|---|---|---|---|

| SBI | Good | Moderate | Broad |

| HDFC | Excellent | Smooth | Rich |

| ICICI | Excellent | Smooth | Rich |

Winner for Digital Banking: HDFC and ICICI (tie) — both deliver superior mobile and online experiences.

Customer Support & Branch Accessibility

SBI

- Strength: Largest bank in India with thousands of branches everywhere — urban, semi-urban, and rural.

- Customer Service: Branch access makes in-person support easier, but wait times can be longer.

- Phone and Online Support: Available but not always prompt.

HDFC Bank

- Strength: Strong service quality at branches in urban areas.

- Customer Service: Quick digital support and responsive call centers.

- Network: Fewer branches compared to SBI, but good coverage.

ICICI Bank

- Strength: Good branch network in cities and towns.

- Customer Service: Generally fast support via digital channels.

- Network: Comparable to HDFC with reliable coverage.

Winner for Accessibility: SBI — unbeatable physical presence.

Winner for Customer Support Experience: HDFC and ICICI — faster, more responsive digital support.

Additional Features & Benefits

Let’s look at extra features that sweeten the savings account experience.

SBI Savings Account Benefits

- Lower minimum balance.

- Wide ATM network.

- Access to SBI’s ecosystem (loan offers, investments, credit cards).

- YONO app for banking plus lifestyle benefits.

HDFC Savings Account Benefits

- Robust digital banking features.

- Exclusive rewards & offers on debit card spends.

- Wealth management tie-ins.

- Personalized banking for premium customers.

ICICI Savings Account Benefits

- iMobile app with advanced features.

- Attractive onboarding offers via digital sign-up.

- Partner benefits (discounts on lifestyle, entertainment).

- Flexible account variants (e.g., regular, Express).

Bonus Value: Both HDFC and ICICI often offer rewards and cashback on debit transactions, shopping partners, and festival offers.

Feature Winner: HDFC and ICICI for value-added perks; SBI for broad banking ecosystem.

Best for Different Types of Customers

Let’s simplify the choice by personifying the ideal customer for each bank.

Best For Students & Beginners

✅ SBI — Easier balance requirements, wide accessibility, reliable banking basics.

Best For Digital-First Users

✅ HDFC or ICICI — Smooth apps, advanced features, better rewards on online spends.

Best For Frequent Travelers Across India

✅ SBI — Unmatched branch + ATM coverage.

Best for Rewards & Premium Banking

✅ HDFC & ICICI — More perks, lifestyle offers, exclusive deals.

Best for Low Cost & Simple Banking

✅ SBI — Lower charges and easier balance rules.

Short Verdict: Which Bank Is Best?

After comparing SBI vs HDFC vs ICICI savings accounts:

✔ If your priority is low cost, accessibility, and simplicity: SBI Savings Account wins.

✔ If you value seamless digital banking, rewards, and a premium experience: HDFC or ICICI Savings Account is better.

✔ No one-size-fits-all: Your choice depends on your lifestyle and requirements — digital savviness, travel frequency, budget comfort, and spending habits.

How to Choose the Right Savings Account for You

To decide confidently, ask yourself:

- How often will I maintain the minimum balance comfortably?

- Will I use digital banking features frequently?

- Do I want rewards on debit card spending?

- Do I need a bank that’s accessible everywhere?

- Am I planning to link investments, loans, or insurance soon?

Understanding your priorities will help you pick the best savings account among SBI, HDFC, and ICICI.

FAQ

Which bank offers the highest interest on savings accounts?

Interest rates fluctuate, but HDFC and ICICI often offer competitive rates that can be slightly higher than SBI’s. Always check current rates before deciding.

Is SBI better than HDFC or ICICI?

SBI is better for accessibility and low cost, while HDFC and ICICI shine in digital banking and extra perks.

Do these banks charge for non-maintenance of minimum balance?

Yes — all three banks charge penal fees if you don’t maintain the required minimum balance, but SBI’s penalties are usually lower.

Can I open a savings account online with these banks?

Yes — SBI, HDFC, and ICICI all support online savings account opening through apps and their websites.

Which bank’s mobile app is the best?

HDFC’s MobileBanking App and ICICI’s iMobile are both top-rated for ease of use, speed, and features.

Conclusion

Choosing the best savings account between SBI, HDFC and ICICI depends on what matters most to you. If you prefer low cost and wide reach, SBI is ideal. If you value digital convenience and rewards, HDFC or ICICI are strong contenders.

Weigh what matters most — cost, tech features, branch access, and perks — and pick the bank that helps grow and simplify your money.

Write a comment