Banking customers in India have been hearing more about RBI banking rule changes — new regulations and guidelines issued by the Reserve Bank of India (RBI) that directly impact how banks operate and how account holders experience financial services. Whether it’s updates around digital payments, interest crediting timelines, service charges, or security protocols, these changes are meant to strengthen the banking system, protect customers, and improve efficiency.

In this comprehensive guide, you’ll learn what the key RBI banking rule changes are, why they were introduced, and — most importantly — how they affect you as an account holder.

What Are RBI Banking Rule Changes?

The Reserve Bank of India (RBI) is India’s central bank and financial regulator. Among its key responsibilities are supervising banks, issuing currency, managing monetary policy, and protecting consumer interests. From time to time, RBI updates banking rules to reflect economic shifts, technology advancements, fraud risks, customer feedback, and international standards.

These RBI banking rule changes may include:

- New service standards for customer grievance redressal

- Revised fee and charges norms

- Updated timelines for fund transfers or interest crediting

- Enhanced security guidelines

- Definitions and limits for digital payment services

These rules apply to all scheduled commercial banks, payments banks, small finance banks, and certain non-bank financial institutions.

Why RBI Updates Banking Rules

1. Protect Consumers

The RBI aims to ensure that banking customers are treated fairly, with transparent disclosures and predictable service standards.

2. Strengthen Financial Stability

Regulations help reduce systemic risks — for example, by keeping credit practices sound or ensuring liquidity in banks.

3. Promote Digital and Financial Inclusion

As digital payments grow rapidly in India, guidelines evolve to make them safe, interoperable, and widely accessible.

4. Combat Fraud and Cyber Risks

New rules often mandate stronger authentication and monitoring to protect against fraud in online and mobile banking.

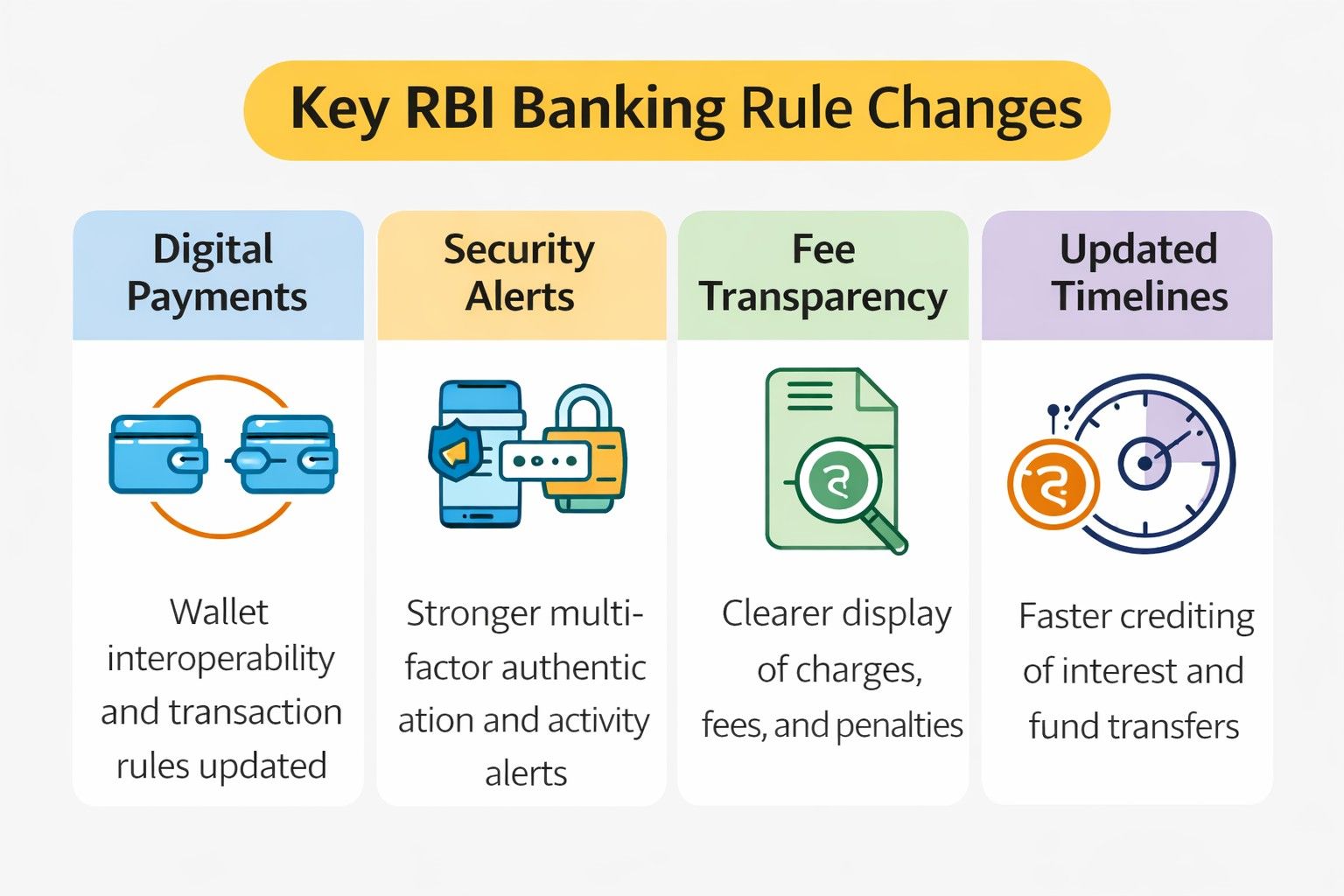

Major Recent RBI Banking Rule Changes

Below are key areas where the RBI has recently introduced or updated banking rules that affect account holders.

Updated Timelines for Interest and Charges

Faster Interest Credit on Deposits

RBI has recommended clearer timelines within which banks must credit interest to savings and term deposit accounts, ensuring customers receive what is due without unnecessary delay.

Transparent Fee Structures

Banks are now expected to publish service charges and penalties in a standardized, easy-to-understand format. This helps customers avoid surprise fees on:

- ATM withdrawals

- Cheque returns

- Passbook updates

- Electronic transfer failures

Digital Payments and Wallets — New Rules

Interoperability Standards

RBI has encouraged interoperability between different digital wallets and payment systems. This means your mobile wallet can work with multiple bank accounts and services without restriction.

Transaction Limits and KYC Upgrades

To curb fraud, certain transaction limits require completed Know Your Customer (KYC) documentation. Non-KYC wallets may continue but with lower limits on load and transfer values.

Enhanced Security and Fraud Protection

Multi-Factor Authentication (MFA)

RBI mandates multi-factor authentication for most digital banking transactions. You may now see additional OTP (one-time password), biometric prompts, or token-based authentication during transactions.

Alerts and Monitoring

Banks must send SMS/email alerts for specific activities — for example:

- Large withdrawals

- Login from a new device

- Unusual transaction patterns

These alerts help customers spot potential fraud early.

Customer Service and Grievance Redressal Rules

Faster Issue Resolution

The RBI has prioritized faster turnaround times for resolving customer complaints. Banks are required to acknowledge complaints quickly and provide clear timelines for redressal.

Escalation Mechanisms

If your complaint is unresolved beyond RBI guidelines, you can escalate it to:

- The bank’s nodal officer

- The banking ombudsman appointed by RBI

The ombudsman is a free service to resolve disputes between you and the bank.

Impact on Loans and Credit

Standardization of Loan Charges

RBI directives now require banks to clearly disclose processing fees, prepayment penalties, and interest reset triggers before loan disbursal.

Faster Sanction & Disbursal Processes

RBI encourages digitized loan applications and approvals to reduce processing times, especially for standard personal, home, and auto loans.

New Rules for KYC and Account Opening

Simplified Account Opening

RBI has allowed for easier onboarding of customers through digital KYC processes — such as video KYC and Aadhaar-based verification — while maintaining safeguards against fraud.

Periodic KYC Updates

To keep your account active and up-to-date, RBI requires banks to periodically refresh your KYC details, especially if your contact information or address changes.

WhatsApp and UPI Integration Guidelines

Banking on Chat Platforms

RBI has permitted banks to offer services like balance enquiry or mini statements via secure messaging platforms like WhatsApp, subject to strict security protocols.

Unified Payments Interface (UPI) Enhancements

UPI is continuously being upgraded with rules around transaction limits, merchant payments, and additional authentication measures to protect users.

What These Changes Mean for You

To help you understand your rights, responsibilities, and how to adapt, here’s what RBI rule changes mean for common banking scenarios:

1. Everyday Banking

Faster Value Credit

Interest and fund transfer timelines are now more regulated, so expect less delay in crediting your account.

Clear Charges

You’ll see clearer disclosures of fees — helping you choose lower-cost services.

Alerts & Notifications

You’ll receive real-time alerts on important account activity, boosting your awareness and security.

2. Digital Payments

More Wallet Flexibility

With interoperability, moving funds between wallets and bank accounts is easier.

Higher Safety

Stronger authentication reduces the odds of unauthorized transactions, especially on mobile apps.

3. Loans and Credit Cards

Transparent Costs

You’ll know the total cost of borrowing up front, including processing fees and prepayment charges.

Faster Approval

Digitized application processes mean some loans can be approved quicker than before — especially for low-risk profiles.

4. Security and Fraud Protection

Safer Banking

Multi-layer authentication and heightened monitoring make digital banking safer.

Monitoring Alerts

You’ll be notified of suspicious activities sooner, letting you act quickly if something goes wrong.

5. Complaint Resolution

Faster Response Times

RBI-backed timelines for addressing complaints mean you’re more likely to see quicker resolutions.

Ombudsman Access

If your issue is unresolved, you have a clear escalation path that’s free and governed by an impartial authority.

Tips to Make the Most of RBI Banking Rule Changes

To take full advantage of the improved protections and services, here are practical tips:

1. Keep Your KYC Updated

Update address, mobile number, email, and Aadhaar details so you don’t face transaction limits or account blocks.

2. Opt-In for Alerts

Enable SMS and email notifications for transactions, due dates, and unusual activities.

3. Review Bank Charges

Check your bank’s published fee schedule and choose the most cost-effective service.

4. Use Digital Banking Securely

Always update your banking app, use strong passwords and biometric locks, and avoid public Wi-Fi for transactions.

5. Know Your Escalation Paths

If a grievance isn’t resolved, use the bank’s nodal officer or the RBI banking ombudsman service.

Common Myths About RBI Banking Rule Changes

Here are a few misconceptions cleared up:

Myth 1: RBI Controls My Money

Reality: RBI sets rules for banks to protect you, but your money remains with your bank. RBI doesn’t access individual accounts.

Myth 2: All Fees Will Be Lower

Reality: RBI mandates transparency, not universal fee cuts. It helps you understand and compare charges.

Myth 3: Digital Payments Are Risk-Free

Reality: Rules increase security, but customers must still follow safe practices.

Frequently Asked Questions (FAQ)

What is the purpose of RBI bank rules?

RBI bank rules protect consumer interests, ensure robust banking operations, and minimize financial risks by setting standards for transparency, security, and efficiency.

Do these RBI changes affect all banks?

Yes, RBI regulations apply to all scheduled commercial banks and other regulated entities unless specified otherwise.

Can the RBI directly withdraw money from my account?

No, RBI cannot directly withdraw funds from your account. Only your bank — with your authorization or due legal process — can debit your account.

How do I know when new RBI banking rules are introduced?

Banks usually notify customers via email, SMS, or updates on their official website. RBI also publishes circulars on its official site.

What should I do if my bank is not following RBI guidelines?

You can lodge a complaint with your bank’s grievance redressal unit. If unresolved, escalate to the banking ombudsman appointed by RBI.

Conclusion

Understanding RBI banking rule changes is essential for every bank account holder in India. These rules are designed to make banking safer, more transparent, and customer-centric. From improved digital payment security to clearer fee disclosures and faster complaint resolutions, you stand to benefit — as long as you stay informed and proactive.

Stay aware, secure your digital banking practices, and don’t hesitate to ask questions or raise concerns with your bank. The RBI’s rules are there to protect you and make your everyday banking simpler and safer.

Write a comment