Sending money online has become second nature, whether through NEFT, RTGS, or IMPS. But a single mistake—like entering the wrong IFSC code—can trigger instant panic. Many people assume their money is lost forever, but that’s not always true.

This detailed guide explains exactly what happens when a wrong IFSC code is used, whether your money will be refunded, how long it may take, and what actions you should take immediately to maximize recovery.

Introduction to Wrong IFSC Code in Bank Transactions

An IFSC code plays a crucial role in identifying the destination bank branch during an electronic fund transfer. If this code is incorrect, the banking system may fail to route the transaction properly.

In most cases, Indian banking systems are designed with safeguards. These checks prevent money from being credited to the wrong account when critical details don’t match.

What Is an IFSC Code and Why It Matters in Transactions

1. Understanding the Structure of an IFSC Code

An IFSC code is an 11-character alphanumeric code that uniquely identifies a bank branch. The first four characters represent the bank, the fifth is usually zero, and the last six indicate the branch.

Even a small typo can redirect the transaction or cause it to fail entirely.

2. Role of IFSC Code in NEFT, RTGS, and IMPS

The IFSC code ensures your money reaches the correct branch before being credited to the beneficiary account. Without a valid match between IFSC and account number, transactions usually cannot be completed.

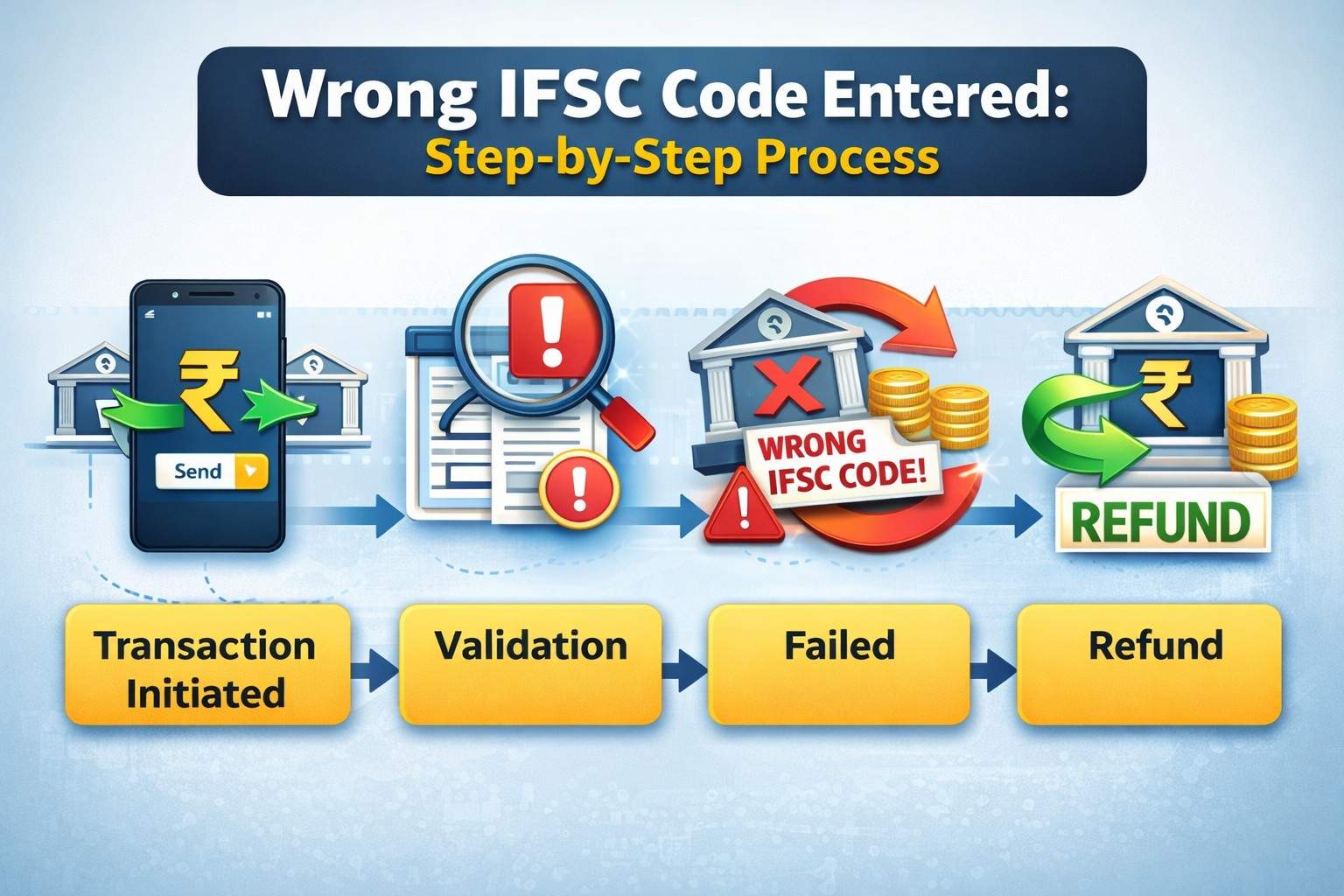

What Happens If You Enter the Wrong IFSC Code

1. Scenario Where Account Number Is Correct but IFSC Is Wrong

If the IFSC code does not match the account number, banks typically reject the transaction. In such cases, the amount is not credited to the beneficiary.

2. Scenario Where Both IFSC and Account Number Exist

In rare cases, if the wrong IFSC code belongs to another valid branch and the account number exists there, the transaction may be credited. This situation requires immediate action for recovery.

Will Money Be Refunded If Wrong IFSC Code Is Used

1. Automatic Reversal by Bank Systems

In most cases, yes. If the IFSC code is invalid or does not correspond with the account number, the transaction fails and the money is automatically reversed.

2. Time Taken for Refund

Refund timelines vary by transaction type. NEFT usually takes 2–5 working days, RTGS may reverse within 24–48 hours, and IMPS reversals often happen within a few hours.

Refund Timelines Based on Transaction Type

1. NEFT Transactions

NEFT operates in batches. If a mismatch is detected, the amount is typically returned within a few business days.

2. RTGS Transactions

RTGS is real-time but still includes validation checks. Failed RTGS transfers are usually reversed faster than NEFT.

3. IMPS Transactions

IMPS is instant, but failed transactions are often auto-reversed the same day or within 24 hours.

What to Do Immediately After Entering a Wrong IFSC Code

1. Check Transaction Status

Log in to your bank account or mobile app and verify whether the transaction is successful, pending, or failed.

2. Contact Your Bank Without Delay

If the transaction shows as successful, contact your bank’s customer support immediately. Early reporting improves recovery chances.

How Banks Handle Wrong IFSC Code Complaints

1. Internal Bank Investigation Process

Banks trace the transaction using reference numbers and verify whether the funds were credited or stuck in transit.

2. Inter-Bank Coordination

If another bank is involved, your bank will coordinate with the recipient bank to initiate a reversal or recovery request.

Can Money Be Credited to the Wrong Person

1. Possibility of Incorrect Credit

Though rare, this can happen if both IFSC and account number match an unintended beneficiary.

2. Legal and Bank Recovery Process

Banks contact the recipient and request consent for reversal. If the recipient refuses, legal remedies may be required.

Common Mistakes That Lead to IFSC Code Errors

1. Copy-Paste Errors

Copying IFSC codes from outdated websites or old messages often leads to mistakes.

2. Using Old IFSC Codes After Bank Mergers

Bank mergers frequently change IFSC codes. Using an old code may cause transaction failure.

Tips to Avoid Wrong IFSC Code Transactions in the Future

1. Verify Beneficiary Details Twice

Always cross-check the IFSC code and account number before confirming the transfer.

2. Use Bank-Verified Beneficiary Lists

Adding beneficiaries and waiting for activation helps reduce errors during urgent transfers.

FAQ

What if the transaction shows successful but money not received

If the transaction is successful but the beneficiary hasn’t received the money, contact your bank immediately with the transaction reference number.

Can banks reverse money without recipient consent

Banks usually require recipient consent if money is credited to the wrong account. Without consent, legal procedures may apply.

Is wrong IFSC code considered my responsibility

Yes, entering correct details is the sender’s responsibility, but banks assist in recovery wherever possible.

How long should I wait before raising a complaint

You should raise a complaint within 24 hours if the transaction status is unclear or shows successful incorrectly.

Will I lose money permanently due to wrong IFSC

In most cases, no. The majority of wrong IFSC transactions are automatically reversed.

Conclusion

Using the wrong IFSC code in a transaction is stressful, but it rarely results in permanent loss. Banking systems are designed to detect mismatches and reverse funds automatically in most scenarios.

Quick action, timely communication with your bank, and accurate record-keeping significantly improve recovery chances. Staying cautious and double-checking details before every transfer remains the best prevention strategy.

Write a comment