Banking has become mostly digital, but many common users still get confused when asked to enter an IFSC code or MICR code. These terms appear on cheques, bank passbooks, and online transfer forms, yet their purpose often remains unclear.

This article explains the difference between IFSC and MICR code in a simple, practical way. By the end, you’ll know what each code means, when it is required, and why banks still use both.

Introduction to IFSC and MICR Code in Banking

1. Why banks use identification codes

Banks handle millions of transactions daily. To avoid errors, delays, and misdirected payments, every bank branch is given unique identification codes. These codes ensure that money reaches the correct branch without manual verification.

2. How IFSC and MICR help common users

For everyday users, these codes make online transfers, cheque clearing, and automated processing faster and safer. While both codes identify bank branches, their purpose and usage are different.

What is IFSC Code and How It Works

1. Meaning and full form of IFSC

IFSC stands for Indian Financial System Code. It is an 11-character alphanumeric code assigned to every bank branch by the Reserve Bank of India.

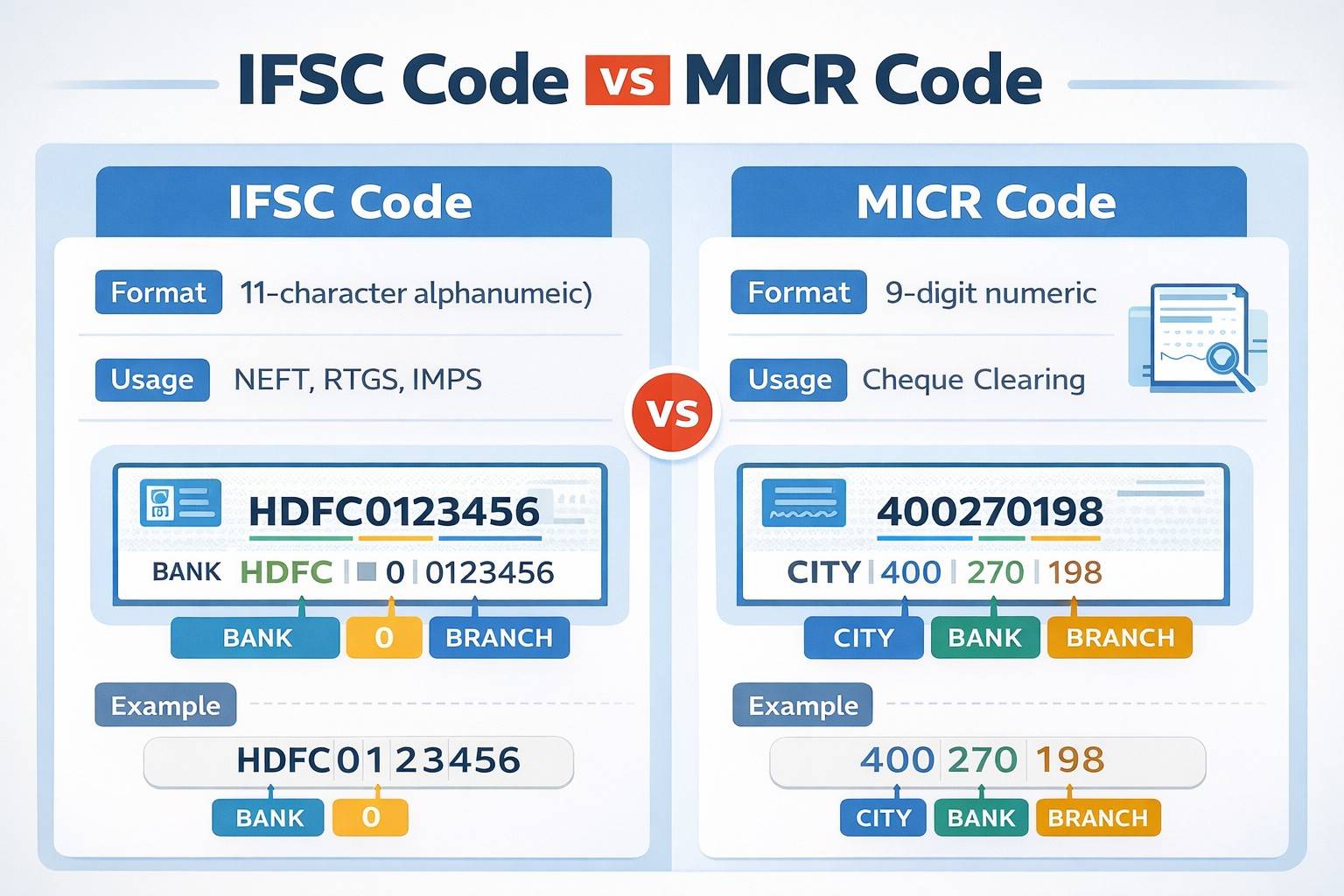

2. Structure of an IFSC code

An IFSC code follows a fixed pattern:

- First 4 letters represent the bank

- Fifth character is always “0”

- Last 6 characters identify the specific branch

Example format: ABCD0XXXXXX

3. Where IFSC code is used

IFSC is mainly used for electronic fund transfers such as NEFT, RTGS, and IMPS. Without the correct IFSC, online transfers cannot be processed successfully.

What is MICR Code and Why It Exists

1. Meaning and full form of MICR

MICR stands for Magnetic Ink Character Recognition. It is a 9-digit numeric code printed at the bottom of cheque leaves.

2. Structure of a MICR code

The MICR code is divided into three parts:

- First 3 digits represent the city

- Next 3 digits represent the bank

- Last 3 digits represent the branch

3. Where MICR code is used

MICR is used mainly in cheque processing. It allows machines to read cheque details quickly and reduces errors during clearing.

Difference Between IFSC and MICR Code

1. Purpose and functionality

IFSC is designed for electronic transfers, while MICR is designed for physical cheque clearing. One supports digital banking, the other supports traditional cheque-based transactions.

2. Format and length

IFSC is alphanumeric with 11 characters, whereas MICR is purely numeric with 9 digits. Their formats reflect the systems they support.

3. Usage for common users

You need IFSC when sending money online. You need MICR only when dealing with cheques, usually without entering it manually.

IFSC vs MICR Code Comparison Table

| Feature | IFSC Code | MICR Code |

|---|---|---|

| Full Form | Indian Financial System Code | Magnetic Ink Character Recognition |

| Length | 11 characters | 9 digits |

| Type | Alphanumeric | Numeric |

| Main Use | Online fund transfers | Cheque clearing |

| Used By | Customers and banks | Mainly banks |

| Printed On Cheque | Sometimes | Always |

Where You Can Find IFSC and MICR Codes

1. On cheque books

Both IFSC and MICR codes are printed on cheque leaves. MICR appears at the bottom in magnetic ink, while IFSC is usually printed above.

2. On passbooks and bank statements

Most banks print IFSC codes on passbooks and statements. MICR may or may not be included.

3. Through online banking platforms

You can find both codes on bank websites, mobile banking apps, and official branch directories.

Common Mistakes Users Make With IFSC and MICR

1. Entering MICR instead of IFSC

Many users mistakenly enter MICR code in online transfer forms, causing transaction failures.

2. Using outdated IFSC codes

After bank mergers, IFSC codes may change. Using old codes can delay or reject payments.

3. Assuming both codes are interchangeable

Although both identify bank branches, they serve different systems and cannot replace each other.

Do You Still Need MICR Code in Digital Banking Era

1. Decline of cheque usage

With UPI and online transfers growing rapidly, cheque usage has reduced significantly for personal banking.

2. Continued relevance for businesses

Businesses, government offices, and legal payments still rely on cheques, keeping MICR relevant.

3. Why banks haven’t removed MICR

Cheque clearing infrastructure is still active, and MICR ensures accuracy and speed where cheques are used.

How to Use IFSC Correctly for Online Transfers

1. Double-check branch details

Always verify the beneficiary’s bank branch before entering the IFSC code.

2. Copy IFSC from official sources

Use bank apps or official websites instead of random online listings.

3. Save verified beneficiaries

Saving verified payees reduces errors in future transfers.

FAQ

What happens if I enter wrong IFSC code

If the IFSC code is invalid, the transaction usually fails. If the code exists but belongs to a different branch, funds may be delayed or returned.

Is MICR code required for NEFT or RTGS

No, MICR code is not required for NEFT, RTGS, or IMPS. Only IFSC code is needed for these transfers.

Can two bank branches have same IFSC code

No, each bank branch has a unique IFSC code to avoid confusion in fund transfers.

Is MICR code still printed on new cheque books

Yes, banks continue to print MICR codes on cheque leaves for clearing purposes.

Can I find IFSC code using account number

Indirectly, yes. Bank apps and customer support can help identify IFSC based on account details.

Conclusion

Understanding the difference between IFSC and MICR code makes banking smoother and stress-free. IFSC is essential for digital payments, while MICR supports cheque-based transactions. Both serve specific purposes and continue to coexist in the Indian banking system.

Knowing when and where to use each code helps you avoid transaction errors and makes you a more confident banking user.

Write a comment