Cheques may look old-fashioned, but they are still widely used for official payments, business transactions, and banking purposes. If you have ever looked closely at a cheque, you might have noticed a special number printed at the bottom. That number is called the MICR code.

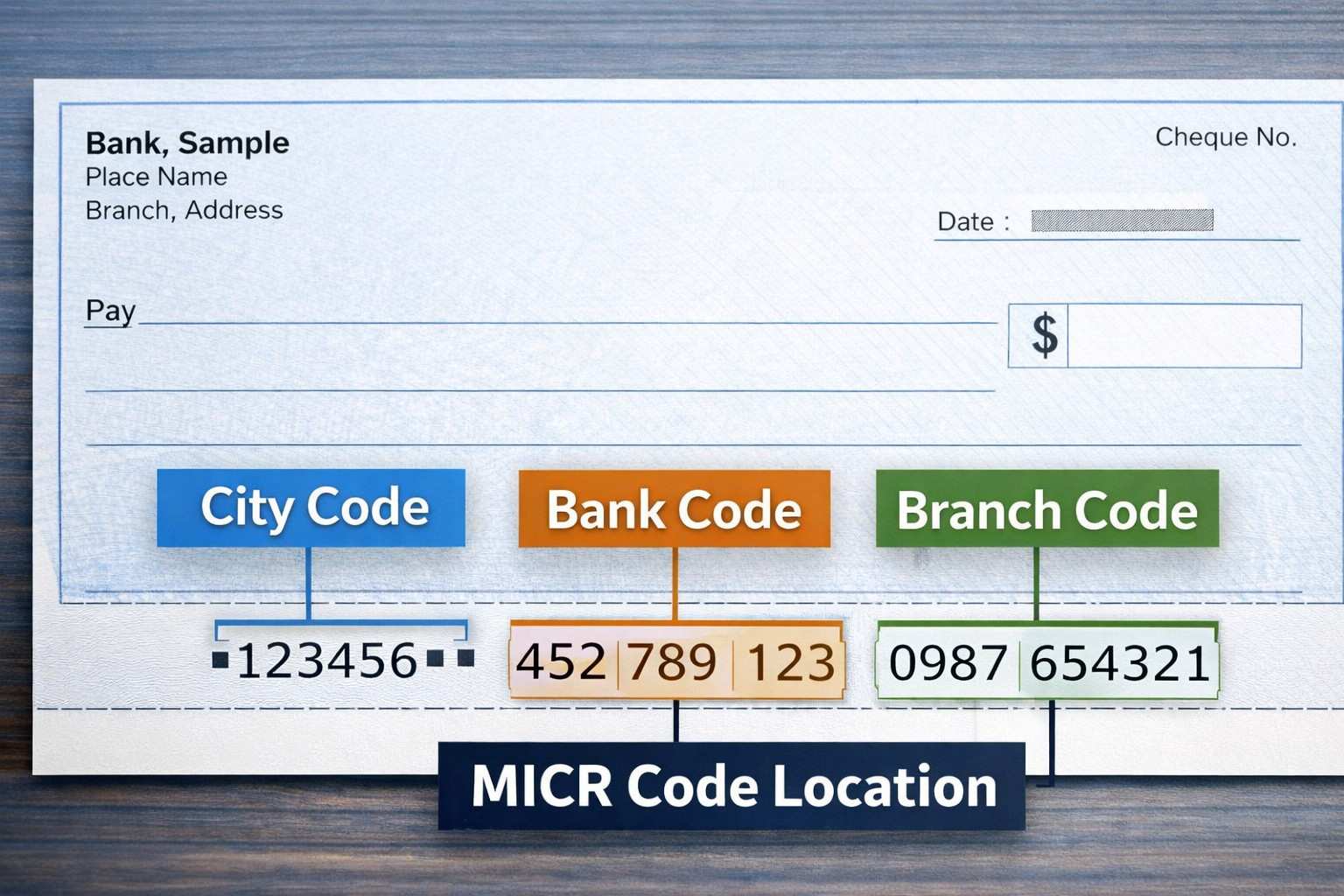

In this detailed guide, you will learn what MICR code is, why it matters, how it works, where to find it on a cheque, and how it differs from other banking codes. A cheque image example is also included to make everything easy to understand.

Introduction to MICR Code

MICR Code is a critical part of the cheque clearing system used by banks. MICR stands for Magnetic Ink Character Recognition, a technology designed to make cheque processing faster, safer, and more accurate.

Banks use MICR codes to identify the bank, branch, and location associated with a cheque. Without this code, automated cheque clearing would be slow and error-prone, especially when handling millions of cheques daily.

What Is MICR Code?

1. Meaning of MICR Code

MICR Code is a 9-digit numeric code printed on cheques using special magnetic ink. It allows banks to process cheques electronically with high speed and minimal manual intervention.

The magnetic ink enables machines to read the code even if the cheque is stamped, marked, or slightly damaged. This makes MICR technology highly reliable for banking operations.

2. Full Form of MICR

The full form of MICR is Magnetic Ink Character Recognition.

It refers both to the technology and the code itself. The system was developed to improve efficiency and reduce fraud in cheque-based transactions.

MICR Code Format Explained

1. Number of Digits in MICR Code

A standard MICR code contains 9 digits. Each group of digits has a specific meaning related to the bank and branch.

2. Breakdown of MICR Code Structure

| MICR Code Part | Digits | What It Represents |

|---|---|---|

| City Code | First 3 digits | City where the bank branch is located |

| Bank Code | Next 3 digits | Unique identifier of the bank |

| Branch Code | Last 3 digits | Specific branch of the bank |

This structured format ensures that every cheque can be traced back to its exact origin.

MICR Code on Cheque: Image Example

1. Where to Find MICR Code on a Cheque

The MICR code is printed at the bottom of the cheque, usually in the center or lower-left area. It appears in a special font and magnetic ink, making it machine-readable.

2. How to Read MICR Code from Cheque

Look for a 9-digit number printed in a straight line at the bottom. This number is separate from the cheque number and account number. The font often looks slightly different from regular printed text.

Why MICR Code Is Important in Banking

1. Role in Cheque Clearing

MICR code enables faster cheque clearing through automated systems. Machines scan the magnetic ink characters and route the cheque to the correct bank and branch.

This automation reduces processing time from days to hours in many cases.

2. Security and Fraud Prevention

Because MICR ink is difficult to replicate, it adds a layer of security. Any tampering or alteration is easier for machines to detect, reducing cheque fraud and human error.

MICR Code vs IFSC Code

1. Key Differences Between MICR and IFSC

| Feature | MICR Code | IFSC Code |

|---|---|---|

| Used For | Cheque transactions | Online transfers (NEFT, RTGS, IMPS) |

| Format | 9-digit numeric | 11-character alphanumeric |

| Printed On Cheque | Yes | Usually no |

| Technology | Magnetic ink reading | Electronic routing |

2. When MICR Code Is Used

MICR code is used mainly for physical cheque processing, while IFSC code is used for digital fund transfers.

How to Find MICR Code Without a Cheque

1. Bank Passbook and Statements

Many bank passbooks and account statements include the MICR code along with branch details.

2. Online Banking and Bank Websites

You can also find MICR codes by visiting your bank’s official website or logging into internet banking. Most banks provide branch search tools that display MICR information.

Common Mistakes Related to MICR Code

1. Confusing MICR with Cheque Number

The cheque number is usually printed on the top and bottom of the cheque, while MICR code appears only at the bottom. Mixing them up can cause transaction errors.

2. Using Wrong MICR Code

Using an incorrect MICR code can delay cheque clearance or cause rejection. Always verify the code if manually entering it on forms or deposit slips.

FAQ

What is MICR code in simple words?

MICR code is a special 9-digit number printed on cheques that helps banks identify the branch and process cheques quickly and safely using machines.

Is MICR code same for all branches of a bank?

No, each bank branch has a unique MICR code, even if the bank name is the same.

Can a cheque be cleared without MICR code?

Manual clearing is possible in rare cases, but it is slow and not preferred. MICR code is essential for fast, automated cheque processing.

Is MICR code required for online money transfer?

No, online transfers use IFSC code. MICR code is mainly used for cheque-based transactions.

How many digits are there in MICR code?

A MICR code contains exactly 9 digits.

Conclusion

MICR code plays a vital role in modern banking by making cheque processing faster, more accurate, and more secure. Understanding where to find it on a cheque and how it works can help you avoid mistakes and delays in transactions.

Even in today’s digital world, MICR technology remains an important backbone of cheque-based payments, ensuring smooth and reliable banking operations.

Write a comment