The Pradhan Mantri Jan Dhan Yojana (PMJDY) is India’s flagship financial inclusion programme aimed at ensuring every household has access to formal banking and financial services. Launched in August 2014, the scheme has reached deep into rural and urban India, opening zero-balance bank accounts and providing insurance, pension, loans, and more.

In 2026, the scheme continues to evolve with expanded benefits and renewed government focus on widening its reach and impact, particularly through recent Budget 2026 proposals aimed at strengthening credit, insurance, and financial empowerment for citizens.

What Is PM Jan Dhan Yojana?

PMJDY is a nationwide financial inclusion mission designed to bring every Indian into the formal banking system. The main goal is to provide affordable access to banking services such as savings and deposit accounts, remittances, credit, insurance, and pension products.

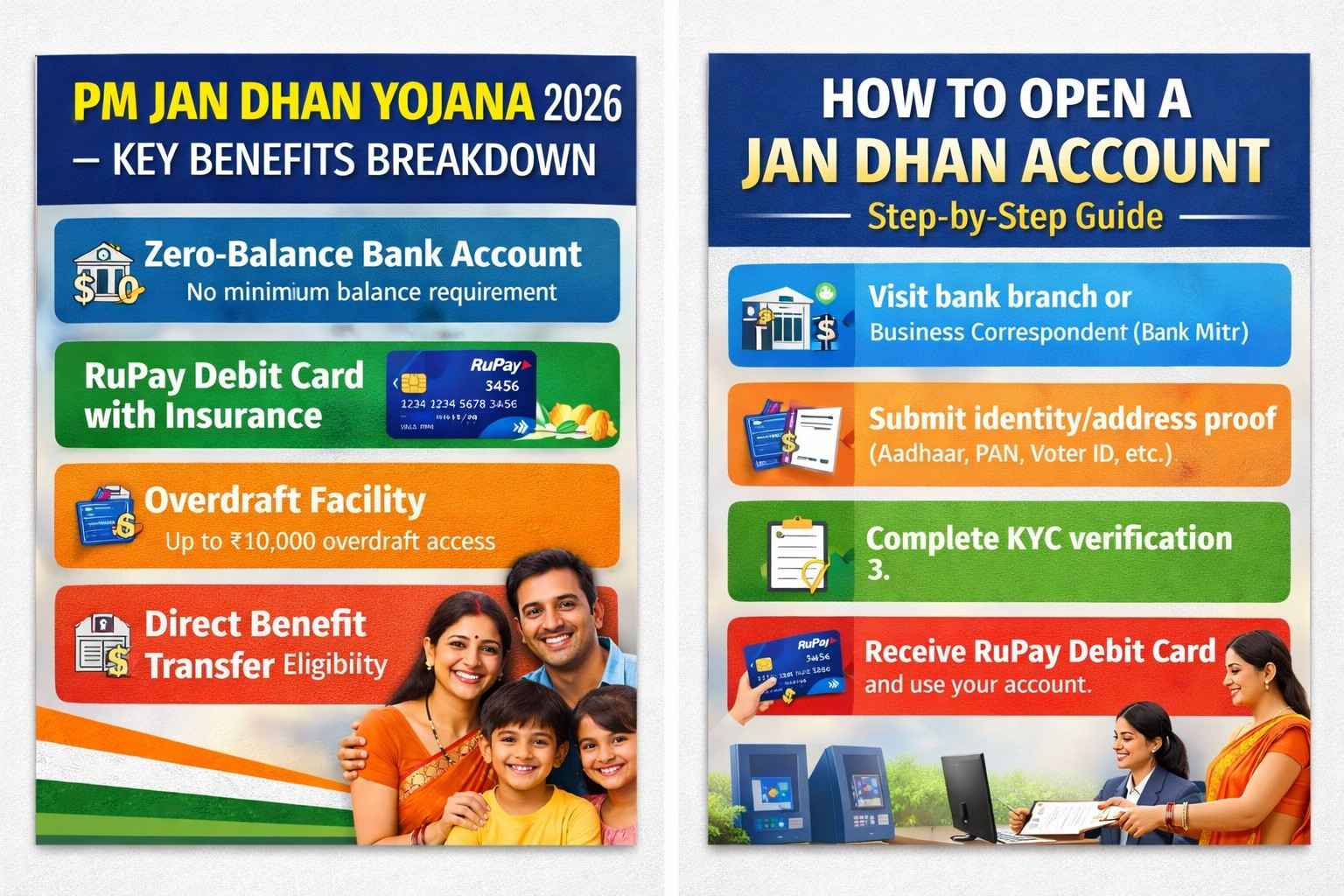

Some core features of the scheme include:

- Zero-balance savings accounts that require no minimum balance. PM Jan Dhan Yojana

- RuPay debit card with accident and life insurance coverage.

- Overdraft facility to eligible account holders.

- Linking Jan Dhan accounts with government benefits for Direct Benefit Transfer (DBT).

Key Benefits of PM Jan Dhan Yojana 2026

1. Zero-Balance Bank Account

Anyone can open a Jan Dhan account with no requirement to maintain a minimum balance, empowering people from all income levels to enter formal banking.

2. RuPay Debit Card With Insurance

Account holders receive a free RuPay debit card that comes with:

- Accidental insurance up to ₹2 lakh.

- Life insurance cover (for eligible first-time account holders).

3. Overdraft Facility

After satisfactory account activity, holders can access an overdraft facility up to ₹10,000 to meet urgent financial needs.

4. Direct Benefit Transfer (DBT) Eligibility

Jan Dhan accounts are used to transfer government subsidies and welfare payments directly to beneficiaries, reducing leakages and middlemen.

5. Insurance and Pension Access

Jan Dhan accounts make beneficiaries eligible for linked financial schemes like:

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

- Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- Atal Pension Yojana (APY)

- MUDRA loans for small businesses

6. Financial Inclusion & Literacy

PMJDY promotes financial literacy and encourages people to understand and use financial services, helping reduce dependence on informal lenders.

Eligibility Criteria for Opening a Jan Dhan Account

To open a PM Jan Dhan Yojana account, you need to meet the following basic eligibility:

- You should be an Indian citizen.

- Age 10 or above (minors aged 10+ can open with a guardian managing the account until 18).

- No prior bank account is required, making it ideal for first-time users.

- Non-Resident Indians (NRIs) are generally not eligible.

Documents like Aadhaar and PAN are typically used for KYC, but low-risk KYC options may allow account opening even without full documentation at the outset.

How to Apply for a Jan Dhan Account

Opening a Jan Dhan account is straightforward:

- Visit any bank branch or Bank Mitr (Business Correspondent) outlet.

- Submit basic identity and address proof (Aadhaar, PAN, voter ID, etc.).

- Complete KYC verification.

- Receive your RuPay debit card and start using the account.

Note: Accounts must remain active and have at least one transaction periodically to maintain insurance and overdraft benefits. Recent government efforts are focused on re-KYC drives to keep dormant accounts active.

Latest Updates for 2026

Government Clarification on Inactive Accounts

Recent media reports claimed banks might close inactive Jan Dhan accounts. However, the Department of Financial Services has clarified that no mandate exists to shut dormant accounts, and instead, banks are promoting awareness and re-KYC campaigns to keep accounts active.

Focus in Budget 2026

The Union Budget 2026 is placing renewed emphasis on Jan Dhan accounts with potential enhancements for women’s financial empowerment:

- Expanded credit and insurance access through Jan Dhan accounts.

- Discussions around customized credit products for women and broader financial services.

- Initiatives to activate dormant accounts and better integrate them into the financial ecosystem.

These proposals reflect the government’s continued commitment to deepen financial inclusion and build a more robust, accessible financial network for all citizens.

Common Misconceptions About Jan Dhan Accounts

Myth: Accounts with No Transactions Will Be Closed

Fact: The government hasn’t ordered mass closure of inactive Jan Dhan accounts; rather, banks are encouraged to engage account holders and update KYC so that benefits can continue.

Myth: Only Poor People Can Open the Account

Fact: Any Indian citizen who satisfies basic eligibility criteria can open a Jan Dhan account, not just low-income individuals.

Impact of Jan Dhan Yojana

Massive Financial Inclusion

Over the years, hundreds of millions of bank accounts have been opened under PMJDY, significantly reducing financial exclusion in India and bringing formal financial services to underserved populations.

Empowering Women

A large share of the accounts belong to women, reflecting progress toward gender financial inclusion and women’s economic participation.

Digital Payments & Formal Economy

Jan Dhan accounts, combined with the JAM (Jan Dhan-Aadhaar-Mobile) platform, have revolutionised cash transfers and reduced leakage in government subsidies.

FAQ

What is the main objective of PM Jan Dhan Yojana?

The primary goal is to bring every Indian into the formal banking system by offering zero-balance bank accounts and access to financial services like savings, credit, insurance, and pension.

Who can open a Jan Dhan account?

Any Indian citizen aged 10 or above without an existing bank account can open one. NRIs are not typically eligible.

What insurance benefits do I get?

Jan Dhan accounts include accidental insurance (up to ₹2 lakh) and life insurance for eligible holders through linked RuPay cards.

How does Jan Dhan help with government schemes?

Jan Dhan accounts serve as the banking gateway for Direct Benefit Transfers (DBT) of subsidies and welfare payments, ensuring efficiency and transparency in fund transfers.

Do I need to maintain a minimum balance?

No — PMJDY accounts require zero minimum balance, making them accessible to all.

Conclusion

PM Jan Dhan Yojana remains a cornerstone of India’s financial inclusion strategy in 2026. It empowers citizens with accessible banking, insurance, credit, and welfare transfer mechanisms. With the Budget 2026 focus on expanding credit and insurance through Jan Dhan accounts, the scheme is poised to deliver even greater socio-economic impact in the years ahead.

Write a comment