Finding the correct IFSC code is essential for smooth online banking and secure fund transfers. Whether you are sending money via NEFT, RTGS, or IMPS, a single wrong character can delay or even fail your transaction.

That is where an IFSC Code Finder Tool becomes incredibly useful. Instead of visiting a branch or searching through paperwork, you can now find any bank IFSC online in seconds using simple and reliable methods.

Introduction to IFSC Code Finder Tool

An IFSC Code Finder Tool is an online utility that helps users instantly find the Indian Financial System Code of any bank branch. By entering basic details such as bank name, state, city, and branch, the tool displays the exact IFSC code required for transactions.

This tool is especially helpful for online banking users, businesses, and individuals who frequently make digital payments and want error-free transfers.

1. What is an IFSC Code?

The IFSC code is an 11-character alphanumeric code assigned to every bank branch in India. It helps identify the exact bank and branch involved in electronic fund transfers.

The code structure includes the bank identifier, a reserved zero, and the branch identifier. This standardized format ensures accuracy and security in interbank transactions.

2. Why IFSC Codes Are Mandatory

IFSC codes are mandatory for all major electronic payment systems in India. They ensure that funds are routed to the correct bank branch without manual intervention.

Without the correct IFSC code, transactions may fail, get delayed, or be credited to the wrong account, creating unnecessary complications.

How IFSC Code Finder Tools Work

IFSC Code Finder Tools use official banking databases and updated records to provide accurate results. They simplify the search process by organizing bank branch information in a user-friendly format.

1. Data Sources Used by IFSC Finder Tools

Most tools rely on official banking records and publicly available databases. These databases are regularly updated to reflect new branches, mergers, and code changes.

Because the data is structured and verified, users can trust the accuracy of the results displayed by reliable IFSC finder platforms.

2. Search Process Explained

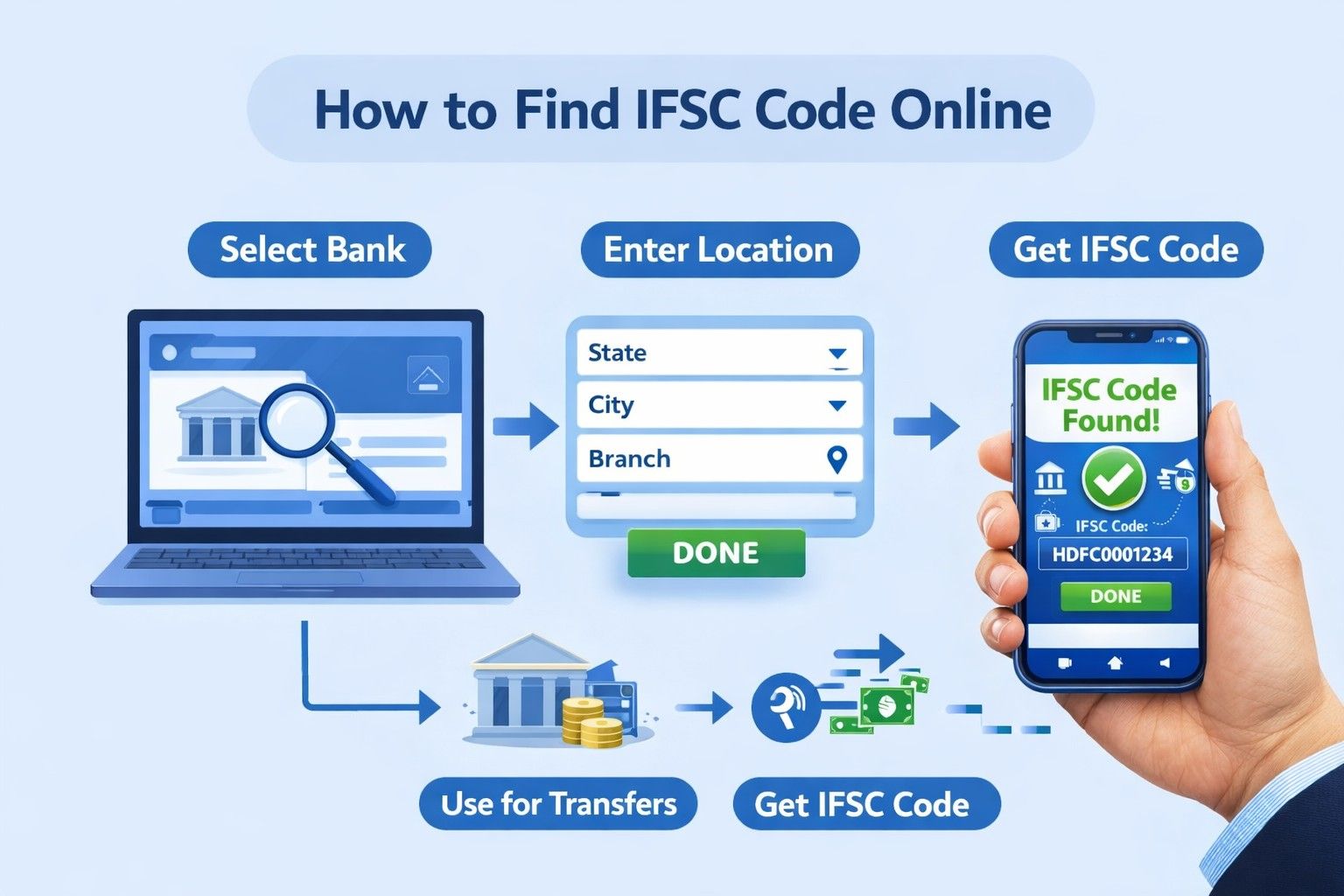

Users typically select or enter the bank name, followed by the state, district, and branch. The tool then instantly fetches the corresponding IFSC code.

Some advanced tools also allow searching directly by branch name or address, making the process even faster and more convenient.

Step-by-Step Guide to Find IFSC Code Online

Using an IFSC Code Finder Tool is simple and does not require technical knowledge. Anyone with internet access can find the required code in seconds.

1. Using a Bank’s Official Website

Most banks provide an IFSC lookup feature on their official websites. You can navigate to the branch locator section and enter branch details.

This method is highly reliable because the information comes directly from the bank’s official records.

2. Using RBI or Trusted Financial Portals

The Reserve Bank of India and several trusted financial portals offer IFSC search tools. These platforms consolidate data from multiple banks.

They are especially useful when you are unsure about the exact branch details or dealing with less common bank branches.

3. Using Mobile Banking and Payment Apps

Popular mobile banking and payment apps automatically fetch IFSC codes when you add a beneficiary. You simply select the bank and branch name.

This method reduces manual errors and speeds up the beneficiary addition process significantly.

Benefits of Using an IFSC Code Finder Tool

An IFSC Code Finder Tool offers several advantages compared to manual methods. It saves time, reduces errors, and improves transaction success rates.

1. Saves Time and Effort

Instead of visiting a bank branch or calling customer support, you can find the IFSC code instantly online.

This is particularly useful during urgent transactions when time is critical.

2. Reduces Transaction Errors

Manual entry of IFSC codes often leads to mistakes. Finder tools minimize this risk by providing verified and formatted codes.

Accurate codes ensure that funds are transferred smoothly without rejections or delays.

Different Methods to Find IFSC Codes

There is more than one way to find an IFSC code. Understanding these methods helps you choose the most convenient option based on your situation.

1. Cheque Book and Passbook

IFSC codes are usually printed on cheque leaves and passbooks. If you have access to these documents, you can find the code easily.

However, this method may not work if the documents are outdated or unavailable.

2. SMS and Customer Support

Some banks offer SMS-based IFSC lookup services. By sending a predefined message, you can receive branch details on your phone.

Customer support helplines can also provide IFSC codes, though this method may take more time.

Common Mistakes to Avoid While Searching IFSC Codes

Even with online tools, users sometimes make avoidable mistakes. Being aware of these errors can save time and prevent failed transactions.

1. Selecting the Wrong Branch

Many bank branches have similar names across different cities. Selecting the wrong branch leads to incorrect IFSC codes.

Always double-check the city and branch address before confirming the code.

2. Using Outdated Information

Bank mergers and branch relocations can change IFSC codes. Relying on old documents or unofficial websites can cause issues.

Always use updated and trusted IFSC Code Finder Tools for accurate results.

Security and Accuracy of IFSC Finder Tools

Users often worry about data security when using online financial tools. Fortunately, IFSC finder tools do not require sensitive personal information.

1. No Personal Data Required

Most tools only ask for bank and branch details. You do not need to enter account numbers, passwords, or personal data.

This makes IFSC finder tools safe for everyday use.

2. Importance of Trusted Platforms

While IFSC codes are public information, accuracy depends on the source. Using trusted and well-known platforms ensures correct data.

Avoid random websites that do not mention data sources or update frequency.

FAQ

What is the fastest way to find an IFSC code?

The fastest way is to use an online IFSC Code Finder Tool where you select the bank, state, city, and branch to get instant results.

Can I find IFSC code using account number?

No, IFSC codes cannot be found using an account number alone. You need bank and branch details to search accurately.

Is IFSC code same for all branches of a bank?

No, each bank branch has a unique IFSC code, even if the bank name is the same.

Are IFSC codes ever changed?

Yes, IFSC codes can change due to bank mergers, restructuring, or branch relocations. Always verify using updated tools.

Can I use IFSC code finder tools on mobile?

Yes, most IFSC Code Finder Tools are mobile-friendly and also available through banking and payment apps.

Conclusion

An IFSC Code Finder Tool is an essential resource for anyone using online banking services in India. It simplifies the process of finding accurate IFSC codes and ensures smooth, error-free fund transfers.

By using trusted online tools and following best practices, you can find any bank IFSC online in seconds and complete your transactions with confidence.

Write a comment