If you have ever transferred money online in India, you must have come across something called an IFSC code. It looks like a short combination of letters and numbers, yet it plays a critical role in banking transactions. Without it, digital fund transfers would simply not work.

This article explains what an IFSC code is, its meaning, format, uses, and real-world examples. By the end, you will clearly understand why IFSC codes are essential and how to use them correctly in everyday banking.

Introduction to IFSC Code

The IFSC Code is a unique identifier used to recognize individual bank branches in India. It ensures that money transfers reach the correct bank and branch without errors.

In simple terms, an IFSC code works like a digital address for a bank branch. Whether you are sending money to a friend or paying a business, the IFSC code tells the banking system exactly where the funds should go.

What Is IFSC Code?

1. Meaning of IFSC Code

IFSC stands for Indian Financial System Code. It is an alphanumeric code assigned to every bank branch that participates in electronic fund transfer systems in India.

This code is issued and regulated by the Reserve Bank of India, ensuring uniformity and accuracy across the banking network.

2. Why IFSC Code Is Important

The IFSC code eliminates confusion between branches with similar names. It ensures faster, safer, and error-free digital transactions across banks and locations.

IFSC Code Format Explained

1. Structure of an IFSC Code

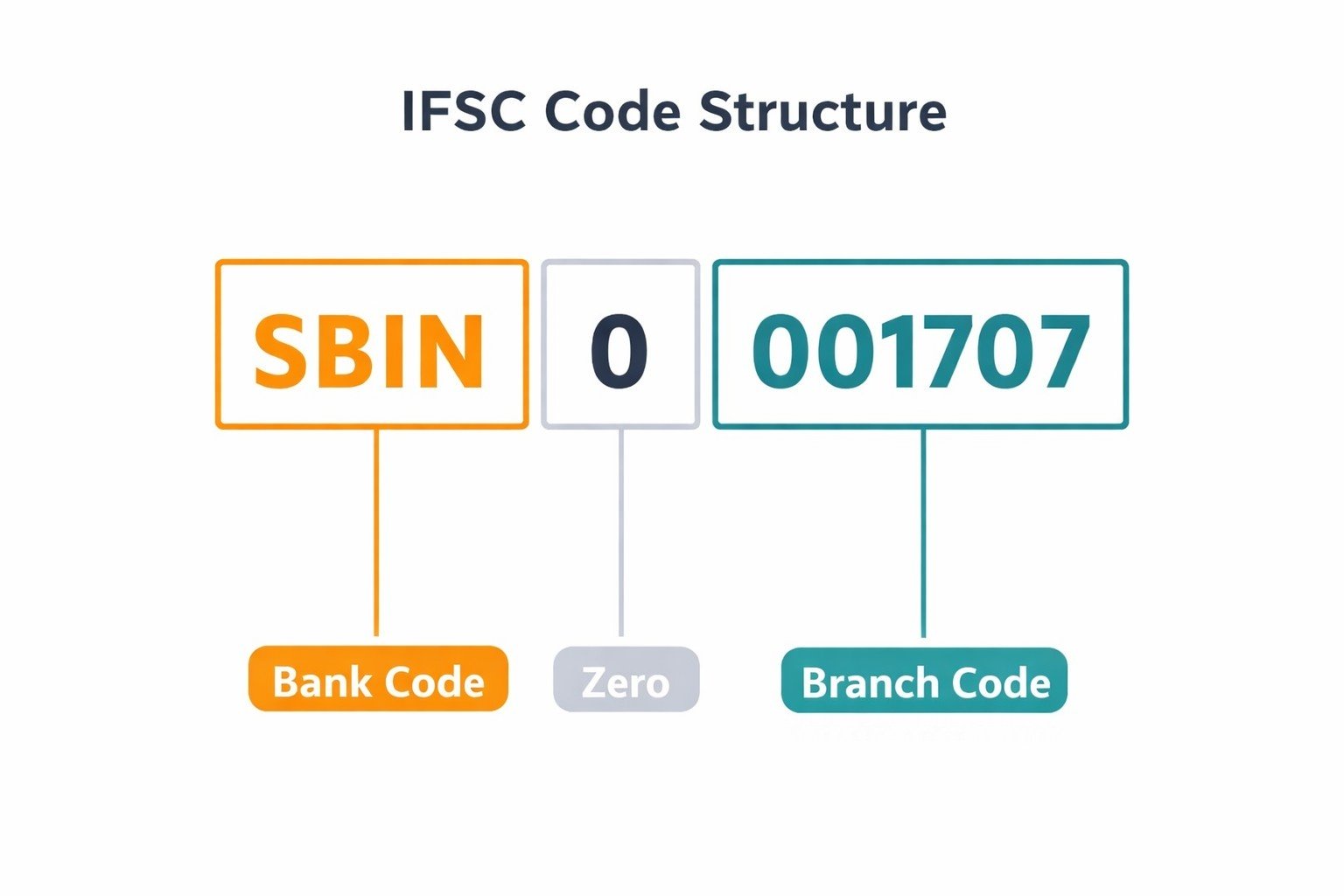

An IFSC code always consists of 11 characters.

Here is how it is structured:

- First 4 characters: Bank code

- 5th character: Always “0” (reserved for future use)

- Last 6 characters: Branch code

2. Understanding Each Part with Example

Take this example: SBIN0001707

- SBIN → Identifies the bank

- 0 → Reserved character

- 001707 → Identifies the specific branch

This structured format helps systems instantly recognize the bank and branch involved in a transaction.

How IFSC Code Works in Banking Transactions

1. Role in Online Fund Transfers

When you initiate a digital payment, the IFSC code acts as routing information. It guides the transaction from the sender’s bank to the receiver’s branch.

2. Behind-the-Scenes Process

Once you enter the IFSC code, the banking network verifies the branch details. If valid, the transaction proceeds. If incorrect, the transfer may fail or get delayed.

Uses of IFSC Code

1. IFSC Code in NEFT Transactions

NEFT uses IFSC codes to route funds between banks securely. Without a correct IFSC code, NEFT transfers cannot be processed.

2. IFSC Code in RTGS Transactions

RTGS is used for high-value transfers. The IFSC code ensures real-time settlement to the correct branch.

3. IFSC Code in IMPS

IMPS transactions rely on IFSC codes for immediate transfers, even outside normal banking hours.

4. IFSC Code for Salary, EMI, and Bills

Employers, loan providers, and utility services use IFSC codes to automate payments accurately.

Examples of IFSC Codes

1. IFSC Code Example for Major Banks

Here are some sample IFSC codes for illustration:

| Bank Name | Branch | IFSC Code |

|---|---|---|

| State Bank of India | New Delhi Main | SBIN0000691 |

| HDFC Bank | Mumbai Fort | HDFC0000060 |

| ICICI Bank | Bengaluru MG Road | ICIC0000104 |

These examples show how each IFSC code uniquely identifies a bank branch.

2. How to Read IFSC Code Examples

Even if you change cities, the bank code remains the same. Only the branch code changes, making identification simple and consistent.

How to Find IFSC Code of a Bank Branch

1. Through Cheque Book or Passbook

Most banks print the IFSC code on cheque leaves and passbooks.

2. Using Online Banking Portals

You can log in to your bank’s website or mobile app to find branch IFSC details.

3. Using RBI or Bank Websites

The RBI and individual bank websites provide official IFSC code directories.

Common Mistakes While Using IFSC Code

1. Entering Wrong Characters

A single incorrect letter or number can cause transaction failure.

2. Using Old IFSC Codes

Bank mergers sometimes change IFSC codes. Always verify before transferring money.

3. Confusing Branch Names

Branches with similar names may have different IFSC codes. Double-check branch details.

Tips to Use IFSC Code Safely

1. Always Verify Before Payment

Cross-check the IFSC code with official sources before confirming transactions.

2. Save Trusted Beneficiaries

Saving verified beneficiaries reduces chances of future errors.

3. Keep Records Updated

If your bank branch changes due to merger or relocation, update IFSC details promptly.

FAQ

What is IFSC code used for?

The IFSC code is used to identify bank branches during electronic fund transfers such as NEFT, RTGS, and IMPS. It ensures money reaches the correct destination without errors.

Can two branches have the same IFSC code?

No, each bank branch has a unique IFSC code. Even branches of the same bank have different codes.

Is IFSC code required for cash deposits?

No, IFSC codes are not required for cash deposits. They are mainly used for electronic and online transactions.

How many digits are there in an IFSC code?

An IFSC code consists of 11 characters, including letters and numbers.

Does IFSC code change?

Yes, IFSC codes may change due to bank mergers, restructuring, or branch relocation. Always verify the latest code before transactions.

Conclusion

The IFSC code is a small but powerful part of India’s banking system. It ensures accuracy, speed, and security in digital fund transfers. Understanding its meaning, format, uses, and examples helps you avoid errors and manage transactions confidently.

Whether you are sending money, receiving salary, or paying bills, using the correct IFSC code ensures smooth and reliable banking every time.

Write a comment